Are your annual donations too much or too little?

Many people wonder, “How much of my income should I donate annually?” While there’s no hard-and-fast rule for everyone, we’ll explore key identifiers to examine when choosing to donate money and several trends that play into why and how much people choose to donate.

Charitable donations make up a varying percentage of individuals’ and families’ budgets. Many people wonder, “How much of my income should I donate annually?”

While there’s no hard-and-fast rule for everyone, there are a few things you should consider when determining your charitable giving for the year. Let it be said that donating any amount of money is admirable and donating even a few dollars per year is a worthwhile cause. That being said, occasionally people look for some form of guidelines or recommendations as to how much they should donate.

We’ll take a look at some key identifiers to examine when choosing to donate money and several trends that play into why and how much people choose to donate.

Are your needs being met?

Before deciding on how much to give, you need to first ensure there’s room in your budget. Think of it like putting on an oxygen mask on an airplane — you have to help yourself before helping others. Your charitable donations should never put your living situation at risk.

Start by calculating the cost of your monthly necessities (rent, utilities, debt payments, food). Take this number and subtract it from your monthly income. This is your flex money. Before you start donating, it’s important to prepare for your future. If you don’t already have an emergency fund or college fund, you’ll want to prioritize building those up. After that, you’ll need to balance dividing your excess between wants, retirement savings, investing, and charitable giving.

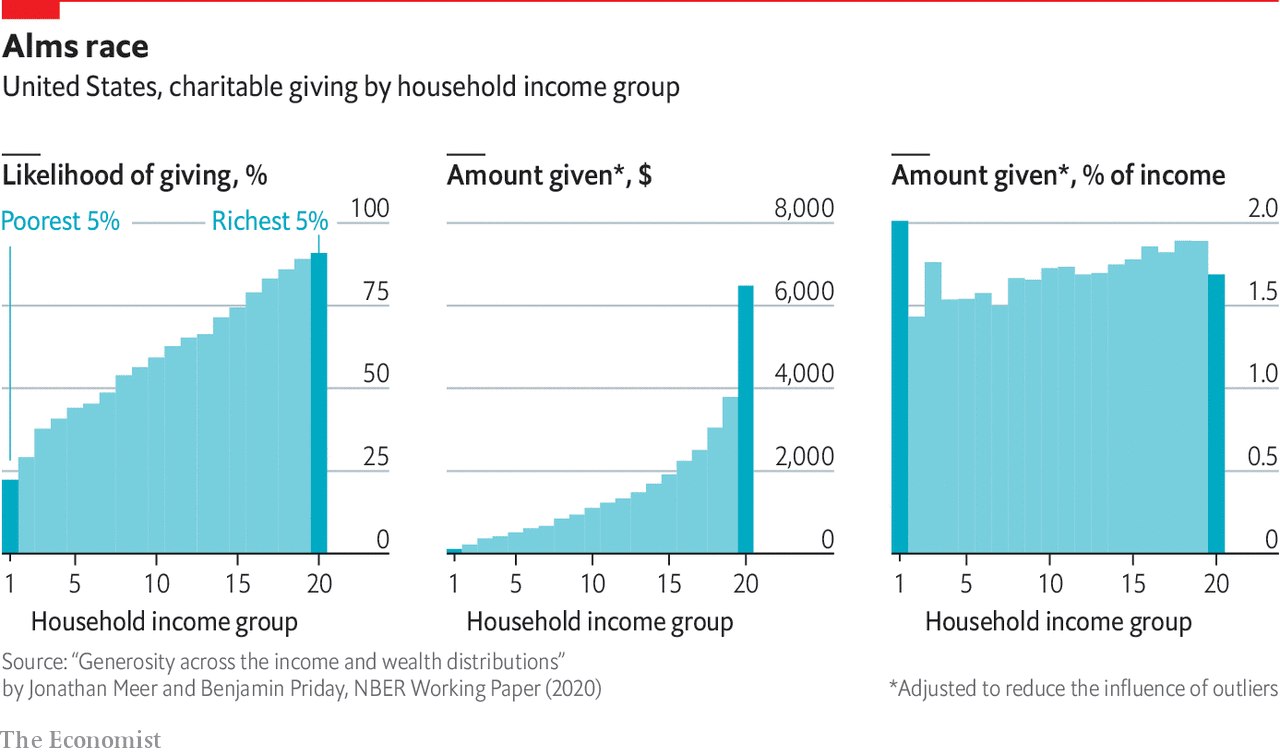

How much do individuals and families give annually?

The most staggering statistic of all is that lower-income families earning between $45K-50K annually donate the second-highest percentage of their income to charitable organizations, only second to households earning more than $10M. While it’s uncertain why lower-income families are amongst the most charitable, a reasonable suspicion could be because these families are more likely to have experienced the struggles of being unable to make ends meet and empathize with those currently facing hardships.

It’s worth noting that while it can be helpful to see how much others are donating, the only person that can make the decision is you. Don’t feel guilty if you’re unable to donate as much as others.

Which causes do you want to support?

Donating to charity gives you the opportunity to support what you’re most passionate about! Whether you care deeply about environmentalism, feeding the homeless, human rights, or protecting animals, chances are there’s an organization that focuses specifically on what you care most about.

Take some time to do research on the different types of organizations that interest you. If you have little ones at home, this is a great opportunity to include them in the conversation and instill charitable values in them. If you give them a weekly allowance, consider encouraging them to donate a portion of their allowance to a cause they care about.

How else can I decide how much to donate?

A commonly thrown-around recommendation is that you should donate around 1.5% of your annual salary to charitable organizations. While this is a solid percentage that is certainly worthy of aiming towards, there are some other options that you can choose to take.

Skip the expensive coffee once a week.

We’re all guilty of indulging in fancy caffeinated drinks. A study found that the average millennial spends over $2,000 on coffee annually! Instead of picking up a $5 coffee on your way to work each day, try and cut down on this expense. Make coffee at home once a week and use the money you would have spent at the local coffee shop to give back your favorite organization at the end of the month. Chances are, you won’t be missing those few coffees a month AND you’ll feel good!

Save your spare change.

Have you ever kept a jar to collect your pocket change? You may have been surprised how much you collected over time. Even with cash transactions on their way out, you can still save your spare change. Digital tools like bunny.money make it easy to save or donate without noticing. These tools analyze your spending to identify excess funds that can be re-directed towards your savings or charitable giving goals.

Donate time instead of money.

If you’re in a position where you’re unable to donate money, perhaps look into volunteering at local organizations. More often than not, these organizations are looking for caring volunteers to donate their time. Whether it be helping serve food at the local soup kitchen or picking up trash alongside the lakefronts, there’s bound to be something that aligns with your personal interests.

What are the other perks of charitable giving?

Aside from feeling good about helping others in need, there are additional benefits to donating money. In the United States you’re able to write-off a certain amount of donations from your taxes each year. You can deduct up to 60% of your adjusted gross income via donations (although this number may vary depending on the type of organization).

Outside of financial benefits, there are emotional perks to giving back! Voluntary giving is known to invoke increased feelings of gratitude and happiness. It also promotes social connection and a greater sense of community.

Save for Good® with bunny.money

bunny.money makes it easy to save and give back to the organizations you care about the most. Get early access to our smart savings app that lets you effortlessly set money aside! From there, it’s easy to donate to organizations you love, with 0% fees!

Photo by Vitaly Taranov @gooner